Every real estate investor’s goal is to make money! They say that scouting for investments and estimating their potential is crucial for success. Property management firms and property owners alike rely on rental rolls to do just that. So, what is a rental roll, and how can it help property owners earn every penny of their investment? Join us below as we discuss the benefits of rental rolls in real estate, tips for assessing ROI INVESTMENT capabilities, and talk about common mistakes to avoid before they eat into your profits!

What Is a Rent Roll in Real Estate?

It’s no secret that keeping detailed financial records is essential for both investors and landlords. In simple terms, the rent roll plays as a statement of the property’s value. It provides property owners with a snapshot of expected and historical income, making it easy to see rental rates, late fees, and lease terms.

Furthermore, it helps landlords determine whether the rental rate aligns with the current market value or if an increase can be made upon renewal. One significant feature is that the rent roll can be broken down by property or unit. Therefore, reviewing a tenant’s payment history and taking action as needed is quite straightforward.

Who Gains in Real Estate from a Rent Roll?

Many individuals benefit from detailed rental rolls in real estate. So, let’s take a look at how these documents assist in various situations:

Property Managers: Rental rolls provide property managers with the opportunity to analyze the performance of rent and make adjustments. This helps in increasing profitability. Furthermore, having a detailed log of transactions is an efficient way to complete daily activities.

Potential Investors: If you are considering selling a property, potential investors can use the rental roll to analyze income performance. Knowing what to expect in terms of income based on the property’s financial history can be a crucial deciding factor in their purchase.

Property Owners: When a property management firm handles daily tasks, property owners use the rental roll to make decisions about their investments. For example, if the rental market rate is underperforming, owners can consider some minor enhancements to increase rental rates and returns.

Banks and Lenders: Looking to refinance? Sure, prepare a rental roll to send to banks or lenders. These institutions use rental rolls in real estate to assess the income-generating ability and asset strength of the property. Additionally, remember that a rental roll in real estate uncovers overall income and doesn’t consider items like mortgage payments, insurance, taxes, utilities, or maintenance.

In a nutshell, rental rolls are a valuable tool in the world of real estate, assisting various stakeholders in making informed decisions and optimizing their investments

What is Included on a Rent Roll?

Now that you know what a rent roll is and how it’s used, let’s dive a little deeper into it. Property management software is responsible for implementing it and creating a rent roll for you. However, creating a rent roll using Excel spreadsheet is quite straightforward. So, once you have the basic template set up in Excel, all you need to do is enter the property owner’s information as it comes in. Keep in mind, each property can be different, and some may require additional details to track with investors.

However, for the fundamentals of setting up a rent roll in real estate, continue reading below:

- Property Information: Begin by inputting the basic details of each property you manage. This includes the property’s address, unit number, and the type of property it is (e.g., apartment, house, commercial space).

- Tenant Information: For each unit or property, list the tenant’s name, contact information, and lease start and end dates. You can more easily keep track of who is renting out each property and when their lease expires thanks to this.

- Rent Amount: Record the monthly rent roll amount for each property. This is crucial for calculating your total rental income.

- Payment Status: Indicate whether the tenant has paid their rent roll for the current month or if there are any outstanding payments. Keeping tabs on this ensures you can quickly address any late or missing payments.

- Lease Terms: Note any specific lease terms or conditions, such as security deposits, pet policies, or maintenance responsibilities. This helps you manage the property according to the lease agreements.

- Vacancies: Update the rent roll to reflect any changes in occupancy. When a unit becomes vacant or is rented out, make sure to adjust the information accordingly.

- Additional Income: If there are any other sources of income related to the property, such as parking fees or laundry income, include them in your rent roll.

- Expenses: Keep track of property-related expenses, such as maintenance costs, property taxes, and insurance premiums. Subtract these expenses from your rental income to calculate your net income.

Landlords and property managers can employ several rent roll, similar to what a buyer does:

Review the latest rental roles and inform the tenant about their obligation to pay rent, estimate late fees, and send notices for late payment.

Identify which leases are expiring soon, and if the current tenant decides not to renew, initiate marketing for the unit’s rental.

Compare the rent collected from the tenant with the current market rents and determine if there is room to increase the rent upon lease renewal.

Evaluate the security deposit collected from the tenant to ensure there are sufficient funds available in case the tenant causes more than normal wear and tear to the property.

You’ll have a clear picture of your real estate investments and be better able to make wise financial decisions if you keep an accurate and current rent roll. Remember that while software can simplify this process, understanding the fundamentals of a rent roll is essential for effective property management.

Document Heading

Rent Heading

In the rental agreement, there should be information that makes it easy for both the property and the owner to be identified. Therefore, make sure that it includes at least the following:

Property Owner’s Name: The name of the property owner.

Rental Property : The address of the rental property.

Property Management Company Name (if applicable).

Unit Details: Specific details about the unit (should match the lease exactly).

Tenant’s Name: The name of the tenant.

Information for Inclusion in the Rent Roll Spreadsheet: This should include details relevant to tracking rental income.

Square Footage: Knowing the property’s square footage is essential for comparing it with local competition and other units.

Bedrooms and Bath Count: Determining the number of bedrooms and bathrooms helps in setting rental rates and comparing with similar properties in the market.

Collected Security Deposit: Record the amount of the security deposit collected from tenants at the time of move-in.

Monthly Rent Amount: Specify the monthly rent amount that is due.

Additional Charges for Tenants: Record any additional charges such as pet fees, utility charges, late fees, or parking fees, and make sure to clarify what each charge represents.

Rent Payment Amount and Date: Document the amount and due date for rent payments each month.

Total Rent Owed: Calculate and record the total rent owed for each month and year. This helps property owners see at a glance how their tenant is doing with payments.

Lease Start Date: Include the date when the lease begins.

Lease End Date: Include the date when the lease ends, so you can plan for renewals or find new tenants.

Comments or Notes: Use this section to add notes about specific unit or Tenant requirements and to track any expected changes.

By putting these specifics in your rental agreement, you’ll have a thorough record that makes it simple to maintain your property and guarantees that both you and your tenant understand the conditions. This will help prevent disputes and streamline the rental process.

How to Tell if a Property Will Be Profitable as an Investment?

How can You tell if Buying a House Will be a Wise Decision?

Rent Roll

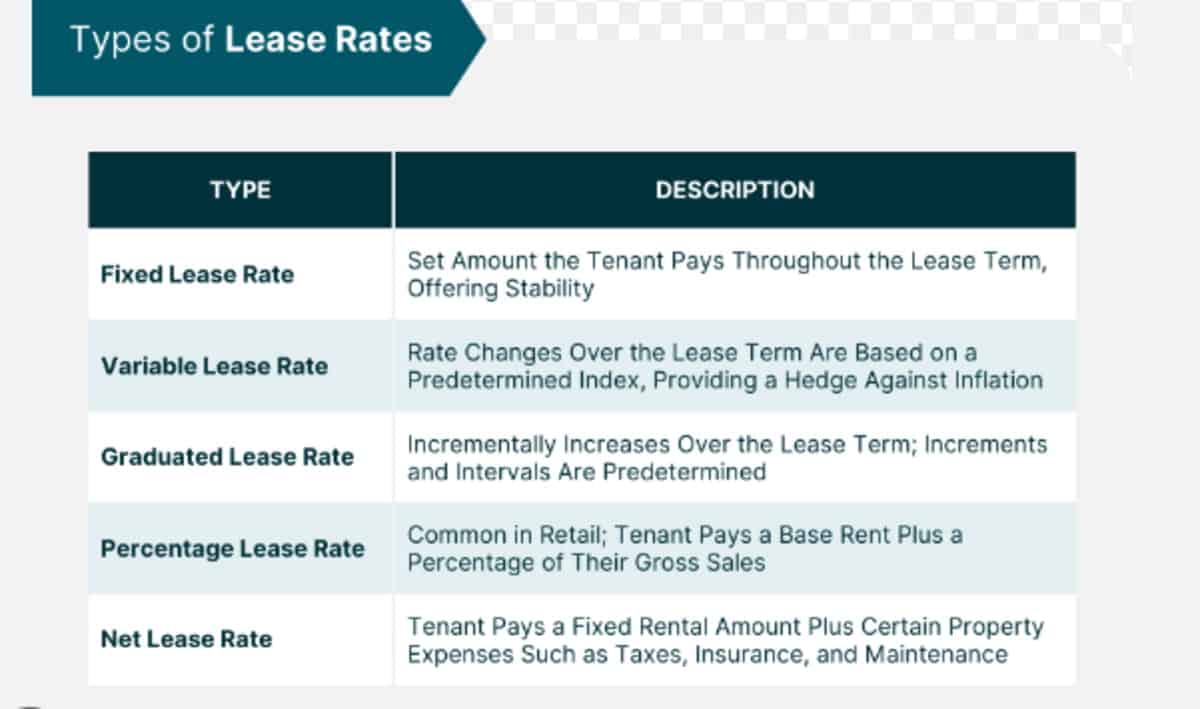

Calculating the cash-on-cash return for investment Cash-on-cash return measures the return on investment in relation to the cash invested. However, keep in mind that this equation doesn’t account for maintenance, mortgage, or property expenses. For example, a property owner is aiming for a cash-on-cash return between 8% to 12%. So, let’s take a look at how to calculate it below.

Step 1: Gross Income – Operating Expenses = Annual Net Income Step 2: Annual Net Income / Purchase Price = Cash-on-Cash Return (as a percentage)

Pro tip: Searching for a quick way to figure out the returns on real estate?

Check out AARP’s free Investment Property Calculator.

1% Rule – Estimating Potential Rental Income

Understanding the margin of profit can significantly impact your decisions among property listings. The 1% rule suggests that your total annual income should be at least 1% of the purchase price. This simple formula helps investors ensure that the property they choose generates enough income to cover expenses. In other words, it ensures that the asset will generate enough revenue to pay for itself.

50% Rule – Expected Expenses

Even the savviest of landlords can’t escape expenses entirely. The 50% rule provides real estate investors with a method to estimate operating expenses compared to their total income. Therefore, the idea is to allocate 50% of your total income towards various expenses and operating costs. Some of these expenses include but aren’t limited to:

- Property taxes

- Property and liability insurance

- Maintenance

- Repairs

- Owner-paid utilities

- Vacancy costs

- Management fees

- HOA obligations

You may make better selections about real estate investments and make sure your finances stay in good shape by following these guidelines.

Profit-Killing Mistakes Every Landlords Needs to Avoid

When it comes to real estate investment in the kingdom, the king is the one who benefits. While preparation plays a crucial role in the profits of real estate, you can still lose money in ways you never imagined. Continue reading below as we outline some typical errors that can endanger your finances and how to avoid them while keeping this in mind.

Mistakes in Profiteering that every property owner needs to avoid:

Location, Location, Location: Not considering the location carefully.

Ignoring the Numbers: Not crunching the numbers.

Spending Without Return: Spending money without a clear return in sight.

Skipping Tenant Screening: Neglecting tenant screening.

Skipping Security Deposits: Not collecting proper security deposits.

Endless Turnovers: Having endless turnovers like a revolving door.

Maintenance Neglect: Letting maintenance issues go unaddressed.

Incomplete Inspections: Not completing thorough inspections.

Cutting Corners on Paperwork: Skimping on paperwork.

Forgetting that Business is Business: Forgetting that real estate is a business.

Remember, real estate investing can be profitable, but to avoid these typical traps, it requires careful thought and attention to detail. Happy investing!

The Location is Key in real Estate, and it’s True for Everyone.

Location is the first principle of real estate. It’s crucial for renters who are looking for convenience and amenities, and it’s also what a property presents. So, if a location falls short in terms of safety, schools, transit, dining, and shopping nearby, investors are in a tough spot.

Therefore, undesirable areas may mean it’ll take more time to rent a property, or it might not attract high-quality tenants that every property owner desires. This impacts your rental income negatively, so choose your location carefully! If the location doesn’t add up in terms of safety, schools, or proximity to transit, dining, and shopping, it can be a challenge for investors.

So, before renting out a property, use available tools to see how it has performed in the past. The rental role in real estate can provide a lot of information about potential listings.

You haven’t Crunched the Numbers.

When considering an investment property, do the math and then do it again. So, if the numbers don’t add up to a profitable investment, move on. Otherwise, neglecting this crucial part of real estate investing can leave you struggling to cover expenses and yielding no profits. Plus, always keep an eye on the market values when renewal time comes around. This ensures it still aligns with local rental market values.

Spending money won’t pay you back.

Not every property improvement will provide the return on investment property owners are looking for. So, be cautious when thinking about any decorations and renovations. Keeping in mind that going for practical designs over luxury or over-the-top ones is a good idea, as they won’t necessarily appeal to a wide range of renters. So, scout the local competition and determine what rent rates different properties command. Then, focus on value-adding elements like neutral colors, durable materials, and multi-function storage or open spaces.

Skipping tenant screening

Having a reliable tenant who pays rent on time and takes care of your property is every investor’s goal. So, to help make this a reality, landlords should require a thorough screening process. Skipping this phase can leave property owners vulnerable to issues, even to the extent of dealing with eviction proceedings. Therefore, investing time and effort into screening helps prevent problems and even roadside troublemakers.

In conclusion, understanding the importance of location, crunching the numbers, being cautious with property upgrades, and conducting thorough tenant screenings are all crucial steps in successful real estate investment. To maintain the profitability and hassle-free operation of your investment property, make wise judgments and attend to the details.

Don’t Skip the Security Deposit Charge

Like completing a background check for a tenant, charging a security deposit properly provides peace of mind to property owners. This deposit helps cover damages beyond normal wear and tear. The security deposit often equates to one or two months of rent. Not collecting the security deposit or just collecting a small amount from tenants will backfire in the end. Therefore, there are three factors to consider when deciding how much deposit is right for your property.

1. What’s a reasonable amount for local competition?

– Research local competition and see what others are charging. If the rent rates are consistent but you’re asking for double the amount, it could deter potential tenants.

2. Does the security deposit amount comply with state or local laws?

– Most states have laws regulating how much a landlord can charge for a security deposit. Knowing these laws helps you avoid hefty fines and consequences for violating local regulations.

3. What does the deposit cover?

Understanding what the security deposit covers helps determine the amount to charge. The deposit can cover unpaid rent roll as well as damages beyond normal wear and tear. That said, always keep copies of receipts and evidence of any damages in case disputes arise.

4.Endless Turnovers Equal Endless Vacancy.

In simple terms, the more time it takes to turnover a property, the longer a landlord has to wait for rent. So, time is of the essence! Expenses pile up quickly, and you’ll want to ensure you have allocated funds and a plan to efficiently turnover units. Failure to do so results in both lost time and profits.

5.Maintenance Issues Come Back to Haunt You.

Protecting your valuable real estate investment requires cooperation between property owners and tenants. So, if you think saving money by neglecting maintenance or skipping inspections is a good idea, you’re mistaken. Not only does neglecting maintenance fail to prevent tenants from withholding rent, but it also negatively impacts your property’s condition. Instead, establish a regular maintenance check-up schedule for larger systems and promptly address maintenance requests.

Do Not Skip Inspections

Conducting regular inspections and going outside is essential! In the other case, how will the property owner know if the tenant has caused any damage and what issues might already exist? This comparison is crucial to determine if any portion of the security deposit can be withheld to cover the mentioned damages. Therefore, always complete a detailed walkthrough, check all items off your checklist, and take pictures both when entering and leaving so you can protect yourself from any unpleasant situations.

Cutting Corners on Paperwork

If you want a successful business, it heavily relies on keeping comprehensive and accurate records. Whether it’s a rental role in real estate or signed contracts, it’s not an area where you should cut corners. Start with a legal lease that matches your specific rental needs. Additionally, it’s a good idea to consult with a qualified attorney for a lease review. Furthermore, consider using rental property management software for help with tracking expenses, tax preparation, applications and leases storage, taking action on work orders, and recording communication with tenants.

Forgetting that Business is Business

Providing excellent customer service to the property owner is essential while maintaining a professional stance. That said, tenant issues are not always the property owner’s issues. This is especially clear with rent roll collection. While it’s easy to sympathize with a tenant going through a tough time, lease terms should be upheld. These problems not only hurt the property owner’s business line, but they may also be against the law in terms of fair housing. Remember; every tenant should be treated equally. So, if you make exceptions for one but not another, it can be seen as discriminatory treatment. Therefore, remember that lease policies are there for a reason and are in place to protect your business.

Final Thoughts

Balancing preparation and ongoing effort is the key to making a profitable business venture. Furthermore, in real estate, calculating returns alongside rental roll and applying tested and true formulas is essential for the property owner’s success. Another useful step in accomplishing your financial objectives is to use the services of a seasoned rental property management firm.

The Property Management Group has the tools and experience to provide property owners with peace of mind. We control daily operations through an easy owner portal that offers comprehensive reports at your fingertips. Our thorough screening and lease processes mean we have a less than 1% vacancy rate. We are so confident in our ability to secure quality tenants for your property that we offer a 6-month tenant guarantee! Call us today to find out how professional rental management can benefit your property’s profitability.